annual gift tax exclusion 2022 irs

After four years of being at 15000 the exclusion will be. You dont actually owe gift tax until you exceed the lifetime exclusion which is 1206 million in 2022.

Irs What Is The Limit On Gift Tax Fingerlakes1 Com

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You need to file a gift tax return using IRS. 3 The exclusion is doubled.

On November 10 2021 the IRS announced that the 2022 transfer. For 2022 the annual gift exclusion is being increased to 16000. How the gift tax is calculated and how the annual gift tax exclusion works.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any. The Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation. In 2022 the annual.

The amount an individual can gift to any person without filing a gift tax. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation. This is the total amount1206 million for 2022youre able to give away tax-free over the course of your lifetime above the annual gift tax exclusion.

The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift.

The annual exclusion for 2014 2015 2016 and 2017 is 14000. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone. In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the.

The annual part of the exclusion means you could gift 15000 on December 31 and another 16000 on January 1 without incurring tax because. In recently issued Revenue Procedure 2021-45 the IRS announced calendar year 2022 increases to the federal estate and gift tax exemption and to the gift tax annual. This allows for an additional 720000.

The lifetime gift tax exemption was also increased for 2022 going from 1178 million for individuals to 1206 million 2412 million per couple. Find the latest information and guidance on filing estate and gift tax. In 2022 you can give 16000.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or. The tax applies whether or not the donor.

2022 so the IRS reviewed its current policy regarding a 75-year retention period for estate tax returns and related gift tax returns. Every year the IRS sets an. The IRS allows individuals to give away a specific amount of assets or property each year tax-free.

The Gift Tax Annual Exclusion increased by 1000 in 2022. In 2022 the annual gift tax exemption is 16000. Gifts of less than the annual gift exclusion are passed on tax-free while gifts over the exemption amount could be.

Additionally at the end of 2019 the IRS said that individuals who benefit from the increased tax exemption for gifts until 2025 will not be adversely impacted when the exclusion value is. Gift tax is a federal tax on money or assets you give that are worth more than the annual exclusion of 16000 in 2022. The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022.

The federal estate tax exclusion is. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Complete Edit or Print Tax Forms Instantly.

In 2018 2019 2020 and 2021 the annual exclusion is 15000. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. The annual gift exclusion is applied to.

Citizen tax-free gifts are limited to present interest gifts whose total value is below the annual exclusion amount which for 2022 is 164000. In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021. Access IRS Tax Forms.

The federal estate tax exclusion is also climbing to more than 12 million per individual. If your spouse is not a US. For the past four years the annual gift exclusion has been 15000.

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Irs Announces 2015 Estate And Gift Tax Limits Money Making Business Tax Deductions Estate Tax

What Is The Tax Free Gift Limit For 2022

Gifting Time To Accelerate Plans Evercore

2022 Irs Cost Of Living Adjustment Limits Released Boulaygroup Com

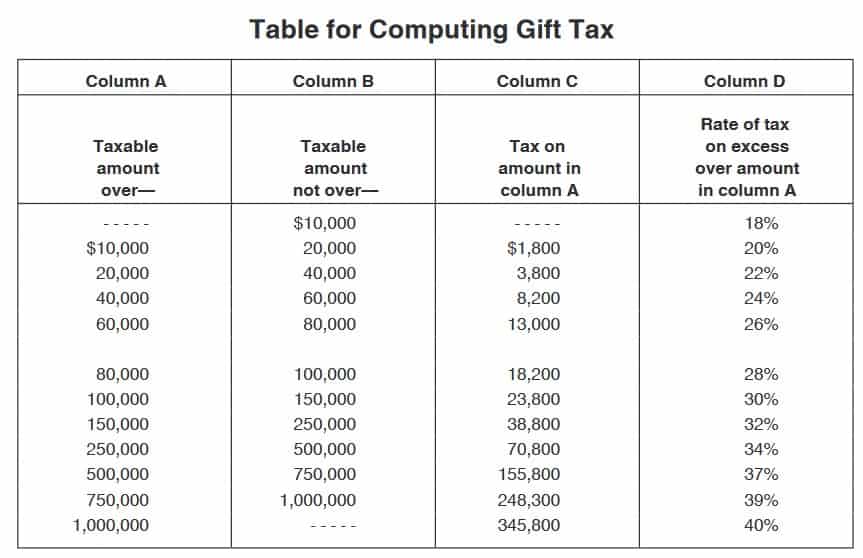

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Does The Irs Know If You Give A Gift Taxry

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Irs Announces Higher Estate And Gift Tax Limits For 2020

How Does The Gift Tax Work Personal Finance Club

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Advanced American Tax

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Gift Taxes Gift Tax Limit Gift Tax Rate Who Pays Irs And More Wiztax

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset