how is a reit taxed

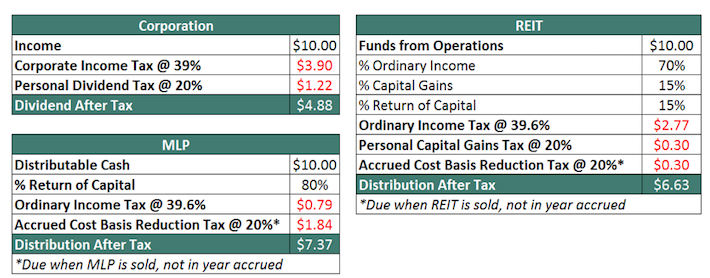

How is REIT income taxed. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment.

How To Use Transfer Pricing To Protect Reit Income

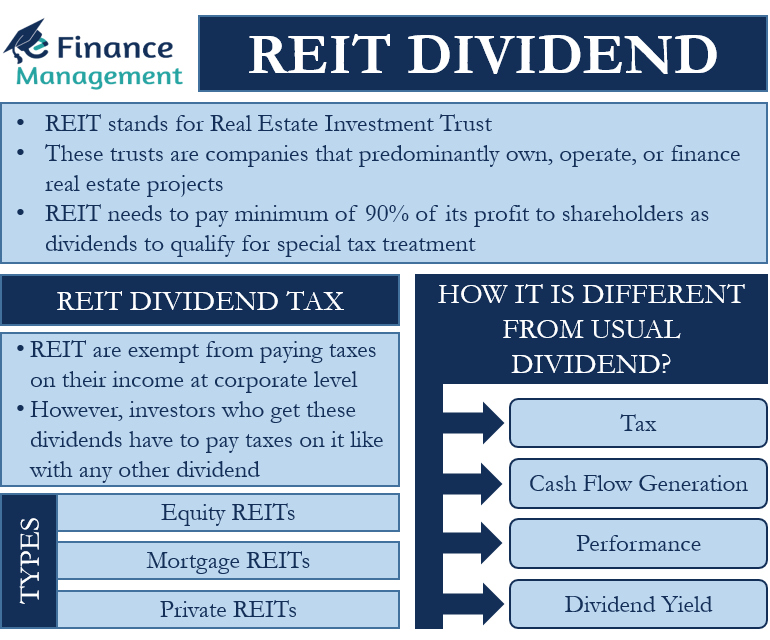

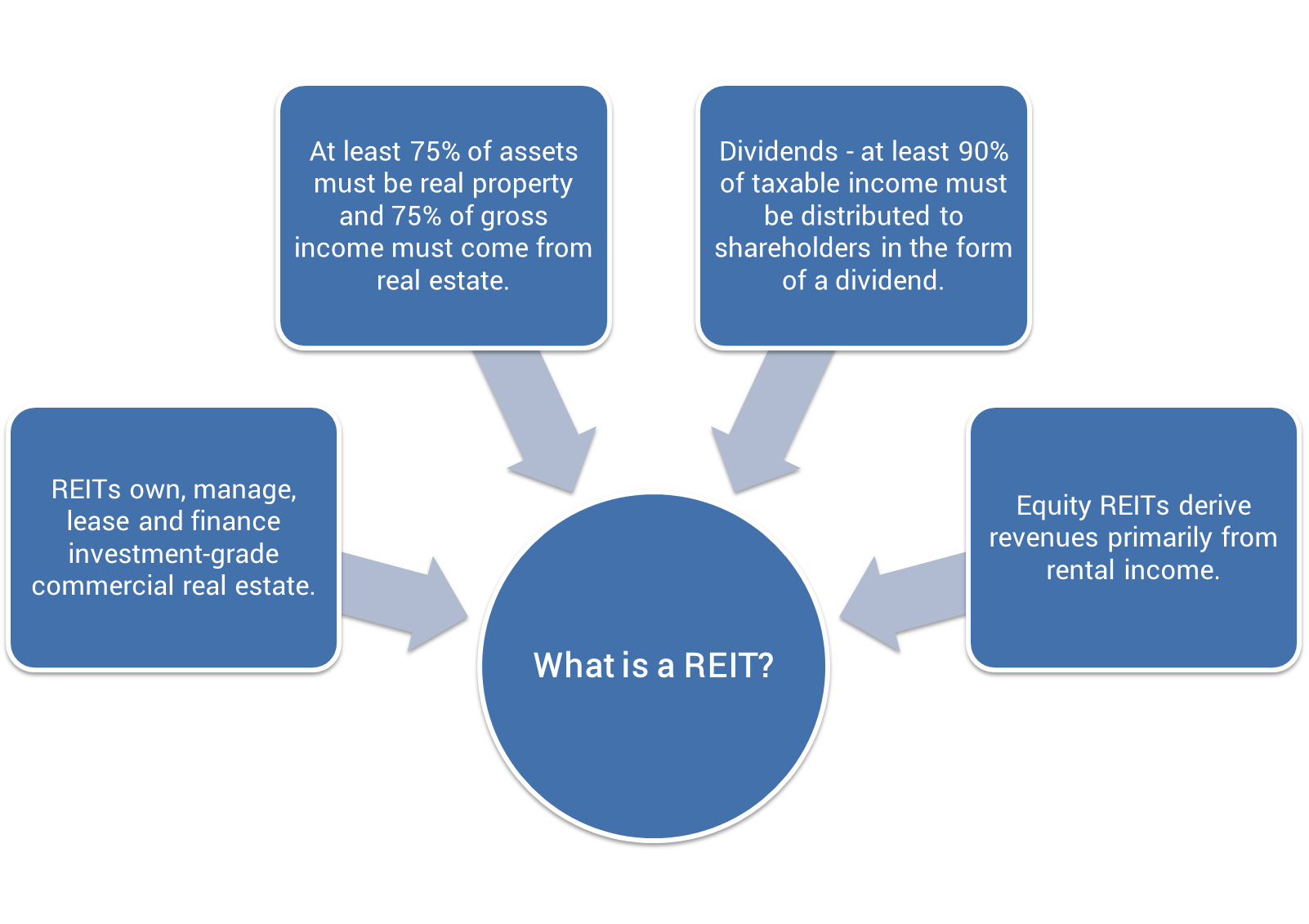

To meet the definition of a REIT the bulk of its assets and income must come from real estate.

. Special Tax Considerations for REITs. You will need to pay tax on any capital gains earned through the sale of. The main tax implications of electing for REIT status are.

More technically a REIT is a qualifying entity that satisfies several federal tax requirements and elects to be taxed as a REIT. Income profits and capital gains of the qualifying property rental business of the REIT are exempt from. REIT investors can deduct up to 20 of ordinary dividends before income tax is.

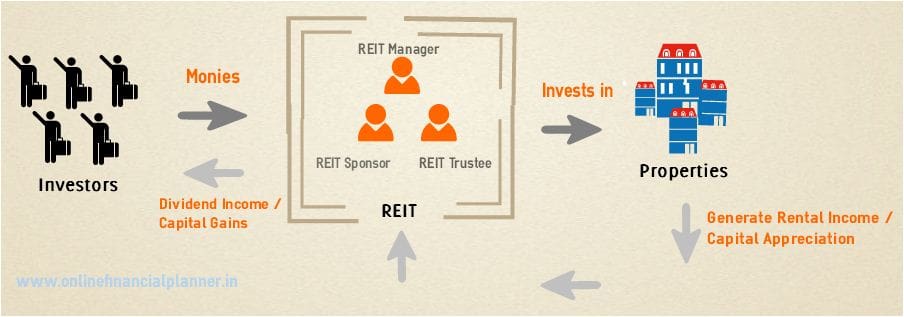

In addition it must pay 90 of its taxable income to shareholders. This is largely because REITs are required to distribute 90 of their REIT taxable income to remain compliant with IRS regulations. Real Estate Investment Trust - REIT.

In exchange for paying out at least 90 of taxable income to shareholders REITs. Diversification of your portfolio Without the potential. A REIT is an entity that would be taxed as a corporation were it not for its special REIT status.

For a company to. There are a few caveats a REIT must meet in order to be viewed as such by the IRS. A real estate investment trust or REIT is essentially a mutual fund for real estate.

REITs that return 90 percent or more of income back to shareholders as dividend payments dont pay corporate income taxes -- that burden is borne by individual REIT. Your REIT ETF company will send you a 1099-DIV form so you can report your dividends and earnings to the IRS. To qualify as a REIT an organization must.

A real estate investment trust or REIT is a company that owns operates or finances income-producing real estate. The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax. As the name suggests the trust invests in real estate related investments.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. This requirement means REITs typically dont pay corpora See more. The REITs taxable income for purposes of the NOL deduction is taxable income line 20 reduced by the dividends paid deduction line 21b and the section 857b2E deduction line 21c.

A REIT is a corporation trust or association that owns and typically manages and operates income-producing real estate or real estate-related assets. First a minimum of 75 percent of assets in a REITs. REITs must follow several requirements including paying at least 90 of taxable income to shareholders as dividends.

Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate. A taxable REIT subsidiary TRS is a corporation that is owned directly or indirectly by a REIT and has jointly elected with the REIT to be treated as a TRS for tax. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

REITs pool the capital of numerous. Several categories of REITs exist and manyincluding.

Sec 199a And Subchapter M Rics Vs Reits

Understanding How Reits Are Taxed

How To Value Reits In 2022 Real World Examples

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

How Are Reits Taxed Including Implications Of The 2017 Tax Cuts And Jobs Act Reits Org

Tax Reform Is A Windfall For Reit Investors

A Guide To Reit Taxation Dividendinvestor Com

Reit Dividend All You Need To Know

Introduction To Reits Adelante Capital Management

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

A Short Lesson On Reit Taxation

Lesson 5 Other Managed Products Flashcards Quizlet

Reits In India Features Pros Cons Tax Implications

Understanding How Reits Are Taxed

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

The Taxman Cometh Reits And Taxes

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

What Is The Reit Dividend Tax Rate The Ascent By Motley Fool